Fidectus launches new Cloud-Service for automatic eSM

Zürich, 21. June 2022 – The Swiss utility Primeo Energie selects the Fidectus platform «Global Energy Network» (GEN) for fully automated settlement...

Today, EFET has launched a report of remarkable significance to the OTC gas and power markets. The study was conducted by PwC and together with 6 European energy companies investigates the impact of earlier settlement dates.

Key findings are:

Our solution:

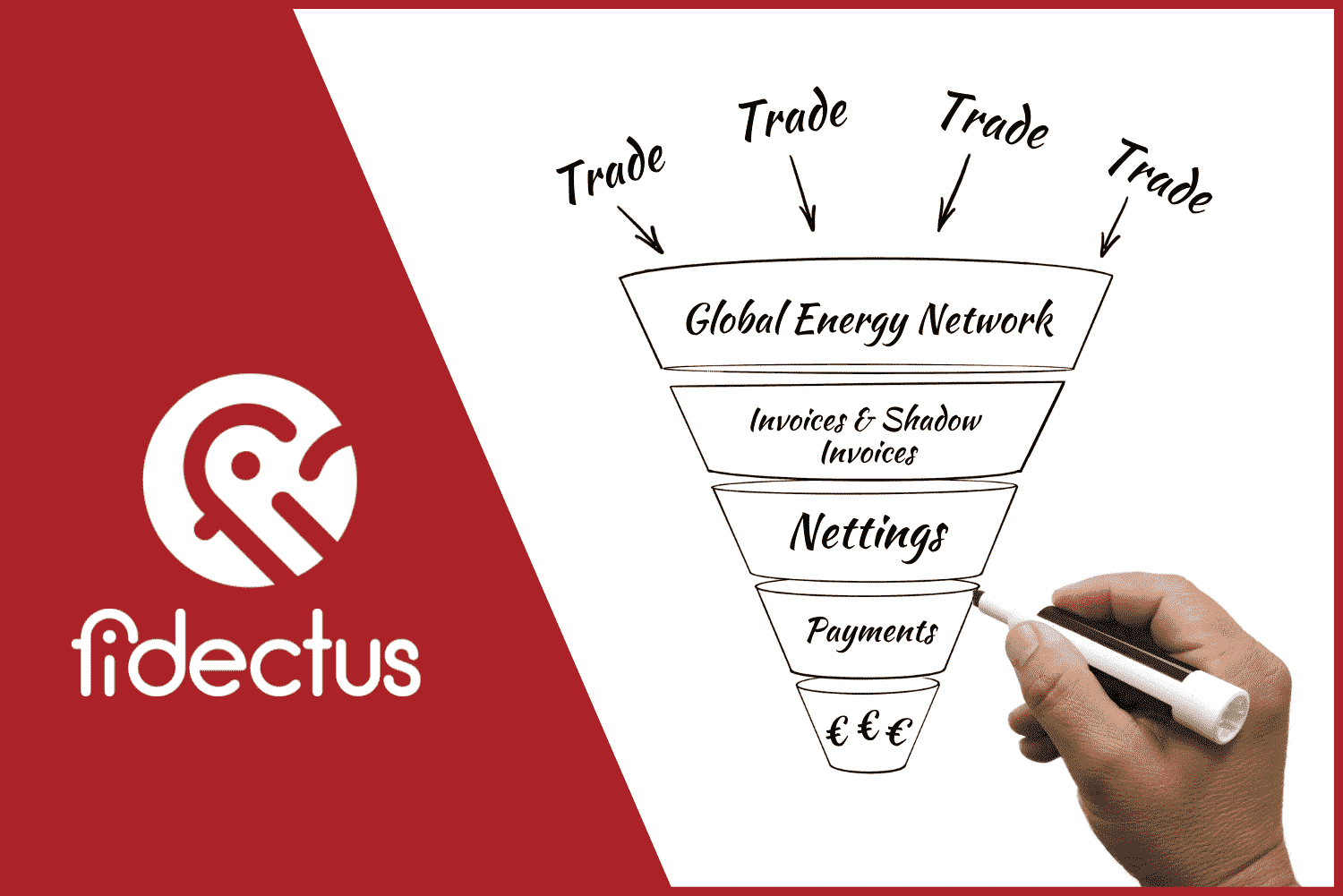

Move to eSM on Fidectus´ Global Energy Network today and unlock the value tied up in your OTC trading operations. Our SaaS is the only available solution that enables you to benefit of earlier settlements with or without your counterparties moving into the same direction. Get in touch with us to schedule a demo.

Zürich, 21. June 2022 – The Swiss utility Primeo Energie selects the Fidectus platform «Global Energy Network» (GEN) for fully automated settlement...

Zürich, August 19, 2020 – This week Jeff Wagner, founder and former CEO of Aquilon, joined Fidectus AG. Jeff founded Aquilon Inc. in 2012,...

Energy Traders Europe (formerly known as EFET) has recently updated and published their industry standards eCM 4.5 for Confirmations and eSM 3.5 for...