Fidectus launches new Cloud-Service for automatic eSM

Zürich, 21. June 2022 – The Swiss utility Primeo Energie selects the Fidectus platform «Global Energy Network» (GEN) for fully automated settlement...

2 min read

Fidectus

:

Apr 14, 2023 10:00:00 AM

Fidectus

:

Apr 14, 2023 10:00:00 AM

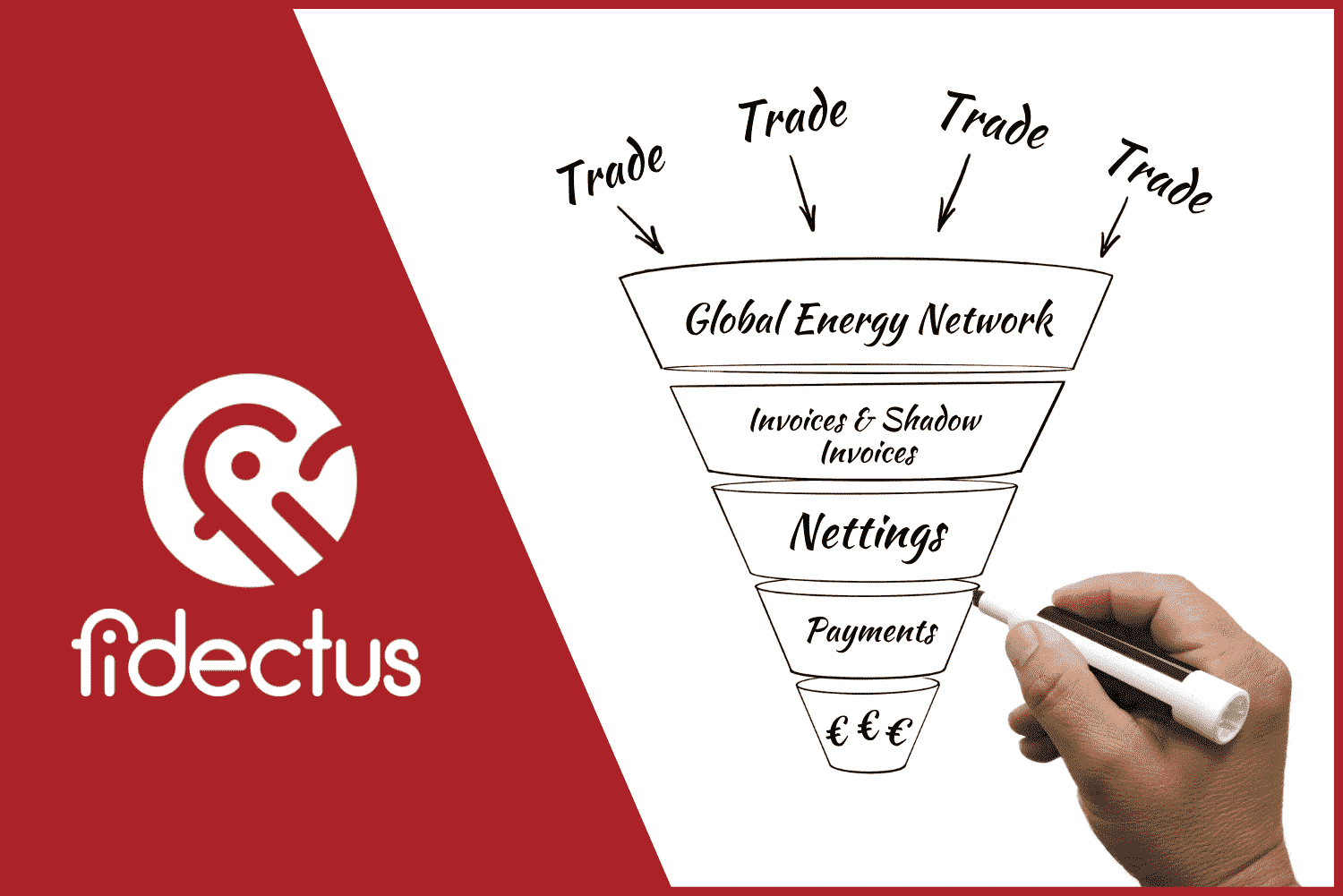

14/04/2023 – Zurich, Switzerland & Bretten, Germany – A new cooperation between SEEBURGER and Fidectus marks a historic milestone in European energy trading. From now on, energy traders and brokers can reach up to 1’500 market participants using an interoperable network from these two energy trading service providers to confirm trades - electronically, legally protected, and fully automated. With this network, SEEBURGER and Fidectus are making a significant contribution to increasing efficiency and scalability in the European energy trading markets. In these currently tense markets, this is being greeted with open arms.

Fidectus and SEEBURGER clients now benefit from automatic matching of their trade confirmations in near real time, regardless of the IT environment, back-office systems and third-party services they may be running. To this end, the partners involved in a trade send each other electronic trade confirmations within or between cloud services. This option is also open to brokers. Confirmed matches are marked as such, and both trading partners are informed accordingly. Manual intervention is only necessary if the trade doesn't return a confirmed match. The network supports the widely used eCM (electronic Confirmation Matching) standard from the European Federation of Energy Traders (EFET).

Stefan Schroeer, director of product management at SEEBURGER is pleased. "This cooperation between SEEBURGER and Fidectus enables users of either matching platform to match their trades with an even larger number of market participants. The interoperability as per EFET standards enables our customers to better meet the increasing regulatory compliance requirements in energy trading, and to reduce risk. The time and money that they save translates to a gain in efficiency. This is regardless of whether they have already switched to electronic confirmations, use our Trade Reporting Solution (TRS) or our Registered Reporting Mechanism (RRM)."

Lorenzo Celio, product manager at Fidectus adds "After we successfully launched interoper-

ability for EFET’s eSM (settlements) in 2022, we can now fulfil the next pressing demand of the energy market. I am therefore delighted to announce interoperability for EFET’s eCM a reality. This is a significant step innovating the whole European energy trading market. The cooperation between SEEBURGER and Fidectus enables all market participants to benefit of automated electronic confirmations. Customers using Fidectus Global Energy Network (GEN) can now reach all their business partners, even via automated email and pdf. Finally, energy traders have access to multiple subsequent and high value post trade cloud services."

What is interoperability?

Interoperability is defined as the ability of trading parties, whether buyer or seller, to exchange and match compliant electronic documents or messages with each other containing fundamentally required information. This occurs regardless of the IT environment, back-office systems or third party solutions or services being used by the trading parties (cf. EESPA 2022).

Zürich, 21. June 2022 – The Swiss utility Primeo Energie selects the Fidectus platform «Global Energy Network» (GEN) for fully automated settlement...

Norlys Energy Trading is going live with electronic Confirmation Matching on Fidectus' Global Energy Networks and takes advantage of the partnership...

23rd September 2024, Zurich and Munich - Fidectus, a platform provider for unified Over-the-Counter (OTC) post-trade solutions, gains strategic...